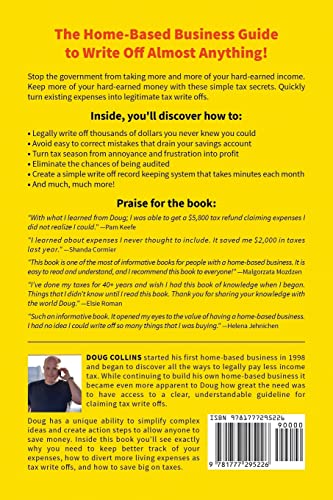

desertcart.co.jp: The Home-Based Business Guide to Write Off Almost Anything: You'll Keep More Money Once You Know These Tax Secret : Collins, Doug: Foreign Language Books Review: I bought this book months ago and like many others, it found its way to a pile of books I like to call "I'll read them eventually". Yesterday was eventually. A simple read, finished it in one sitting and came away with mountains of info that will save me thousands and even get me money back on previous years taxes. Great info on tax investing strategies as well, well worth the purchase price, and I can't wait to write it off!! Review: This was a great simple to read book on taxes. I wish they had this book in schools!

| Customer Reviews | 4.3 4.3 out of 5 stars (475) |

| Dimensions | 6 x 0.44 x 9 inches |

| ISBN-10 | 177729522X |

| ISBN-13 | 978-1777295226 |

| Item Weight | 268 g |

| Language | English |

| Print length | 195 pages |

| Publication date | February 7, 2023 |

| Publisher | Doug Collins |

A**R

I bought this book months ago and like many others, it found its way to a pile of books I like to call "I'll read them eventually". Yesterday was eventually. A simple read, finished it in one sitting and came away with mountains of info that will save me thousands and even get me money back on previous years taxes. Great info on tax investing strategies as well, well worth the purchase price, and I can't wait to write it off!!

A**N

This was a great simple to read book on taxes. I wish they had this book in schools!

M**W

I was scraping pennies for supplies in my small coffee shop located in the lowest level of an office building in Cleveland, OH. "Bookkeeping" consisted of a greasy shoe box nestled in the corner near the window. Tax wasn't an immediate concern because I barely had enough to pay rent. Several years passed. The box became larger and greasier. A friendly customer asked whom I would suggest for tax filing. I said, "When you find someone, let me know." When he visited again, he gave me a business card. By now, the box was bulging. I would have been embarrassed to approach a total stranger, but my customer was kind and I imagined his connection being the same. I got a cleaner, newer box and stuffed receipts corner to corner for facing the music. What does my story have to do with Doug's book? That scary first filing with the kindest person I've met in my long entrepreneurial career taught me a valuable lesson. By the time the accountant stopped laughing at my "bookkeeping", he said, "I'm going to help you this year because you're trying to be a serious business person, but don't ever come to my office again with a shoebox. You have to keep records even if its time consuming. You also need to be incorporated, I'll help." Lucky you! You have a hero.....Doug Collins.

I**R

Whether you are contemplating starting a home-based business or already have one, and whether or not this is a side-hustle or your full time gig, this book will improve your home-based business tax deduction IQ from day 1. Our home-based business journey began in June 2020 as a concept. The business name was registered in January 2021 and throughout the remainder of the 2021 there has been much dedication to preparing for our official launch in 2022. I have spent months researching tax deductions and side hustle revenue implications. If you have also researched this or even scratched the surface…this is what you have discovered; 1). There is a significant amount of conflicting information on how to strategically approach home-based business tax deductions. 2). There are an unlimited amount of tax experts who have limited to no direct experience with home-based business tax deductions. 3) You do not realize the financial opportunities your government provides you when it comes to tax deductions. Doug Collins breaks down your tax deduction opportunities in a reader friendly, non-accountant terminology, non-legalese way which will instantly shift your strategy and mindset. Your home-based business may be unique – and that’s a good thing! Doug’s approach is also unique – and that’s more money in your pocket. My only regret is that I did not discover his book earlier in my home-based business journey. I have read the lower ratings this book has received and although they are in the minority – I simply could not disagree more. Doug clearly explains this book is not a “how-to” do your taxes. This is a strategic level approach to how you should be managing your tax deductions all year long and why you should avoid waiting for the infamous tax season crunch. Your personal experience will be your personal circumstance. In year one of our start-up I went from thinking I would be eligible to submit $3,000 in deductions to almost $6,000 in deductions (and I am not finished number crunching yet). Spoiler alert – the purchase of his book is tax deductible. Thanks Doug!

B**N

I found this book had a lot of easy to read, actionable advice for getting the most advantage you can at tax time. The book is certainly repetitive, but I found that it really reinforced the information provided.

TrustPilot

4天前

1 个月前